who pays transfer tax in philadelphia

In most cases the buyer will pay 2139 and the seller will pay 2139. Documents showing ownership include.

Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

. The city of philadelphia imposes a realty transfer tax on the sale or transfer of real property located in philadelphia. However in Pennsylvania the buyer and the seller typically share this tax equally unless negotiated otherwise with the seller. Contact our office to learn more at 267-423-4130.

Who pays property transfer tax in Philadelphia. In most cases the buyer will pay 2139 and the seller will pay 2139. Realty Transfer Tax The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278.

In the vast majority of circumstances the buyer will pay 2139 percent of the purchase price and the seller will pay 2139 percent. If you need to update your address please call 215 686-6600. You will also be unable to access your tax accounts on the Philadelphia Tax Center.

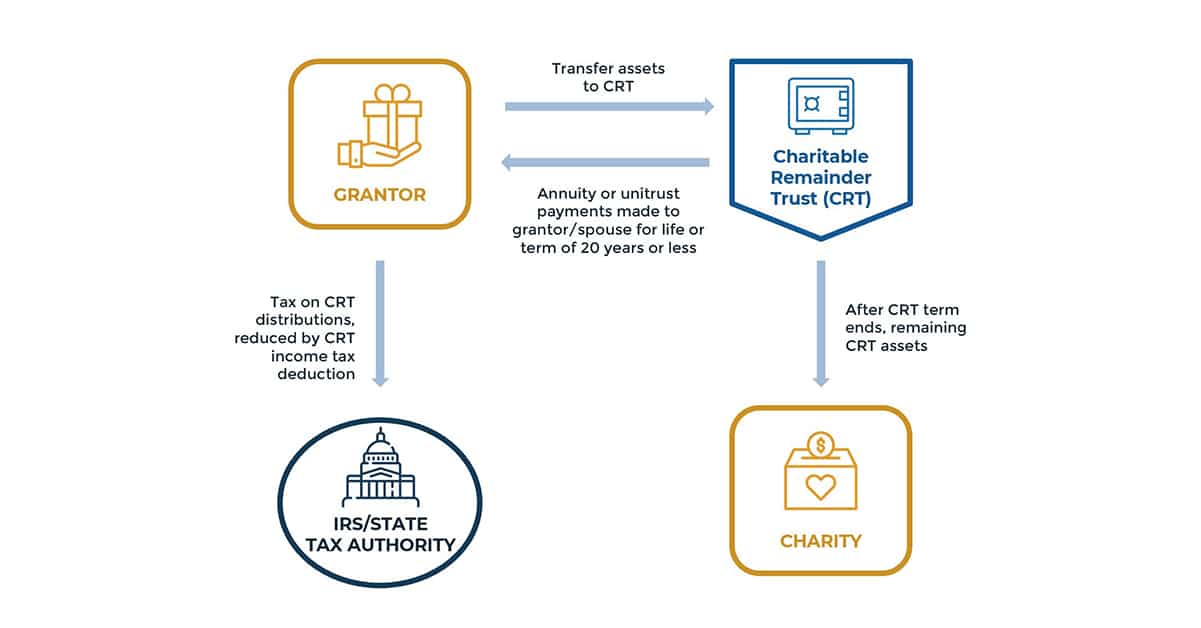

Both grantor and grantee are held jointly and severally liable for payment of the tax. This transfer tax is traditionally split between the buyer and the seller with each party paying half and becomes payable when the property deed or another document showing ownership is filed with the Record of Deeds. Luckily it is customary but not legally required for the buyer and seller to split the transfer taxes evenly.

Real Estate Transfer Tax certificates When you complete a sale or transfer of real estate that is located in Philadelphia you must file and pay the Realty Transfer Tax. In some states such as New York the seller pays this tax. Houses 6 days ago You can pay your Real Estate Tax by credit card over the phone by calling 877 309-3710.

If you experience any problems with this telephone system please contact customer service at 800 487-4567. The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278. To Bucks Berks and Butler the charge for a deed transfer across Pennsylvania is 600 with the sole exception of.

Luckily it is customary but not legally required for the buyer and seller to split the transfer taxes evenly. This was in part due to a 57. Pennsylvania imposes a 1 transfer tax on the value of the real estate being transferred while Philadelphia imposes a 3278 tax on the value of the real estate being transferred.

Who pays Philadelphia transfer tax. Effective october 1 2018 the transfer tax for the city of philadelphia is 3278 with an additional state. For comparison Montgomery County Pennsylvanias transfer tax is only 1.

The Transfer Pennsylvania general sales tax rate is 6. How is Philadelphia transfer tax calculated. Luckily it is customary but not legally required for the buyer and seller to split the transfer taxes evenly.

For ownership transfers only the deed transfer tax is levied. Approximately 1 is collected by the Commonwealth of Pennsylvania and 3 by the City of Philadelphia. The sales tax rate is always 6.

Complete the correct certificate and submit it when you record the deed or mail in your Realty Transfer Tax. Deeds Long-term leases 30 or more years Easements Life estates. Who pays the tax The Realty Transfer Tax applies to the sale or transfer of real estate located in Philadelphia.

The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania. A total of 278 was accounted for in 4 out of six. The tax brought in a whopping 3305 million to the City last year accounting for about 9 of general fund revenues.

In most cases the buyer will pay 2139 and the seller will pay 2139. This transfer tax charged on all real estate transactions is 2 of the purchase price. The exact amount that youll pay in transfer tax will depend on the county or city in which youre located.

Philadelphias transfer tax is one of the highest rates within Pennsylvania. The City has the right to collect 100 of the tax from either party so its in the best interest of the buyer to make sure the tax is paid in full at the closing of the sale. You may use to calculate the cost of deed transfer tax.

Then pay the transfer tax if necessary and record the deed in the recorders office of the county in which the property is located. It is important to know when you may be eligible for one of the many transfer tax exemptions. Deed transfers and entity transfers have their own unique forms.

In most cases the buyer will pay 2139 and the seller will pay 2139. How to file and pay City taxes Services City of. The transfer taxes are split equally among buyers and sellers but they are not legally required to do so.

Our offices can work with you to determine if your real estate transaction may qualify and can help you take the necessary steps to create and record your deed and claim the exemption. The tax is usually split evenly between the buyer and the seller but this is not a legal requirement. Realty Transfer Tax is due when you present the sale document for recordingPay by mail.

Pennsylvania does not have a mortgage tax or revenue stamps. The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278. Transfer tax does not apply to refinancing mortgages unless there is a change in ownership.

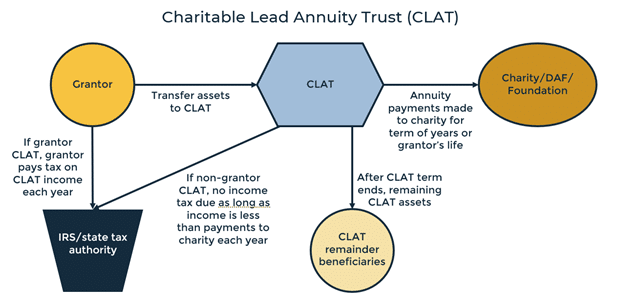

The tax is usually split evenly between the buyer and the seller but this is not a legal requirement. How is transfer tax calculated in Philadelphia. Pennsylvania realty transfer tax is collected often along with an additional local realty transfer tax by county Recorders of Deeds.

Help with tax accounts payments. Bellevue in Allegheny County charges 15 in transfer taxes. The Recorders of Deeds remit the commonwealths 1 percent to the Department of Revenue and the locals have the option to share their realty transfer tax among.

Who Pays Real Estate Transfer Tax In Philadelphia. Luckily it is customary but not legally required for the buyer and seller to split the transfer taxes evenly. Who pays real estate transfer tax in pennsylvania Real Estate Transfer Tax certificates - City of Philadelphia.

The City has the right to collect 100 of the tax from either party so its in the best interest of the buyer to make sure the tax is. The tax becomes payable when a property deed or other document showing realty ownership is filed with the Records Department. In Philadelphia for example 3278 is paid to the city along with the 1 paid to the Commonwealth.

One to the Recorder. This means that the transfer tax is often split evenly between them but this is negotiable and will change according to the real estate market. In Pennsylvania the transfer tax is split between the seller and the buyer and both of them are held accountable for its payment.

What is the amount of the sales tax in Philadelphia.

Escrow Taxes And Insurance Or Pay Them Yourself

Pay Stub Examples And Importance 150 Payslip Templates Ms Word Excel Pdf Payroll Checks Printable Checks Templates Printable Free

1099 Tax Law How Much Tax Do You Pay On 1099 Income Marca

Who Pays Wage Tax And When Department Of Revenue City Of Philadelphia

Psa Don T Pay Tax Software Fee Out Of Your Return R Personalfinance

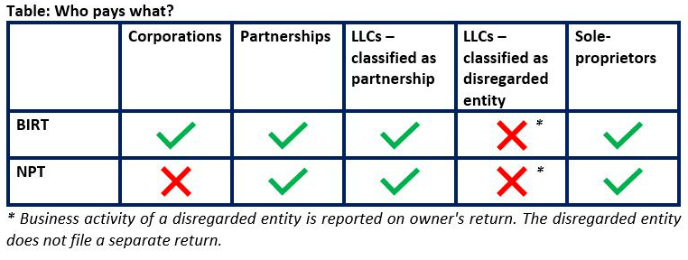

Birt And Npt Philly Business Taxes Explained Department Of Revenue City Of Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Deciding Where To Retire Affects Both Your Lifestyle And Your Wallet During Retirement Part Of Successfully Planning Your Tax Deductions Tax Refund Tax Return

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

States With Highest And Lowest Sales Tax Rates

Transfer Tax Calculator 2022 For All 50 States

How Do I Do Payroll As Self Employed Hourly Inc

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

What Are Real Estate Transfer Taxes Forbes Advisor